First Abu Bank is known as FAB Bank in Dubai or UAE. It is the most popular financial institution in the UAE. There are many ways to check your balance at First Abu Bank in Dubai or UAE. Check your FAB Bank account balance from the comfort of your home.

In today’s article, we will tell you how to check your balance in FAB Bank through Mobile Banking, Mobile App, ATM, FAB Website, and SMS. If you are in the UAE and want to open your bank account, follow the steps below.

Table of Content

ToggleHow to Open a FAB Bank Account

FAB Bank is the most popular financial institution in the UAE. FAB Bank Account can be opened in 2 ways. One through the FAB mobile app, and the other by visiting the branch. If you also want to open your Fab bank account in the UAE then there are two ways below. With the help of this, you can open your account sitting at home or visiting the branch.

How To Activate FAB Mobile Banking?

Fab Bank continues to provide new facilities to its new and old customers. Activate your account from anywhere with the Fab Banking app. There are two ways to enable Fab Mobile Banking.

1) For Registered Customer

Download the Fab Bank app from the Play Store if you have a Fab Bank account. After the app download is installed, set your username and password. You must upload a video selfie to the Emirates ID app for verification. After which your FAB Mobile Banking will be activated.

2) For Non-Registered Customer

If you haven’t already activated your Fab Bank account, download the Fab Bank app now. Remember to have the following items to open your account in Fab Bank Account.

- First, download the FAB Bank app on the Play Store or visit the website.

- Keep your Emirates ID with you.

- Enter your registered number or email in the app.

- Fill the form in the app with your information.

- FAB Bank account fees which may vary from account to account.

- Then apply.

If you have all these things, submit your number and Emirates ID in the app. Select your preferred savings or current account in Fab Account. Choose your favorite 4-digit password to access your Fab Bank app.

After this process your application will be reviewed and your FAB mobile banking system will be activated within 1-2 days. You will then be shown your FAB Mobile Banking System where you can view your balance or your transactions.

Checking FAB Balance Through Mobile App

Checking the FAB account balance in the UAE or anywhere is a very easy process. For this process, the FAB app should be installed on your mobile or any device. If you already have the FAB Banking app, enter your 4-digit password in the app.

You will see the remaining balance of your Fab Account in front of you at the top of the Fab Account Dashboard.

Apart from checking balance, you can pay your bills, transfer between accounts, pay bills, recharge your mobile phone, set up your transactions, and account alerts from your Fab Bank account.

Use in-app fingerprint or enable 2-step Google Authenticator to further secure your account. It is 1st the best way to Check Your FAB Account Balance.

Checking FAB Balance Through ATM

Another way to know your Fab Bank balance is to get balance information from an ATM. Visit your nearest Fab Bank ATM. Insert your debit or credit card into the Fab ATM and enter the 4-digit code at the ATM.

After that, you will see the option to withdraw money, send money, and your balance inquiry. Click on the fab balance inquiry option, then you will see your remaining balance in fab.

If you want to get a receipt, click on get a receipt and collect your balance receipt from the ATM. It is 2nd the best way to Check Your FAB Account Balance.

Checking FAB Balance Through Website

Also, if you don’t want to download the app, or visit an ATM, visit Fab’s official website from this link. Enter the last two digits of your Fab Bank debit or credit card in the box above and your card ID, rewards number, and PIN below. After that, a new window will open click on account now you will see your outstanding balance. It is 3rd the best way to Check Your FAB Account Balance.

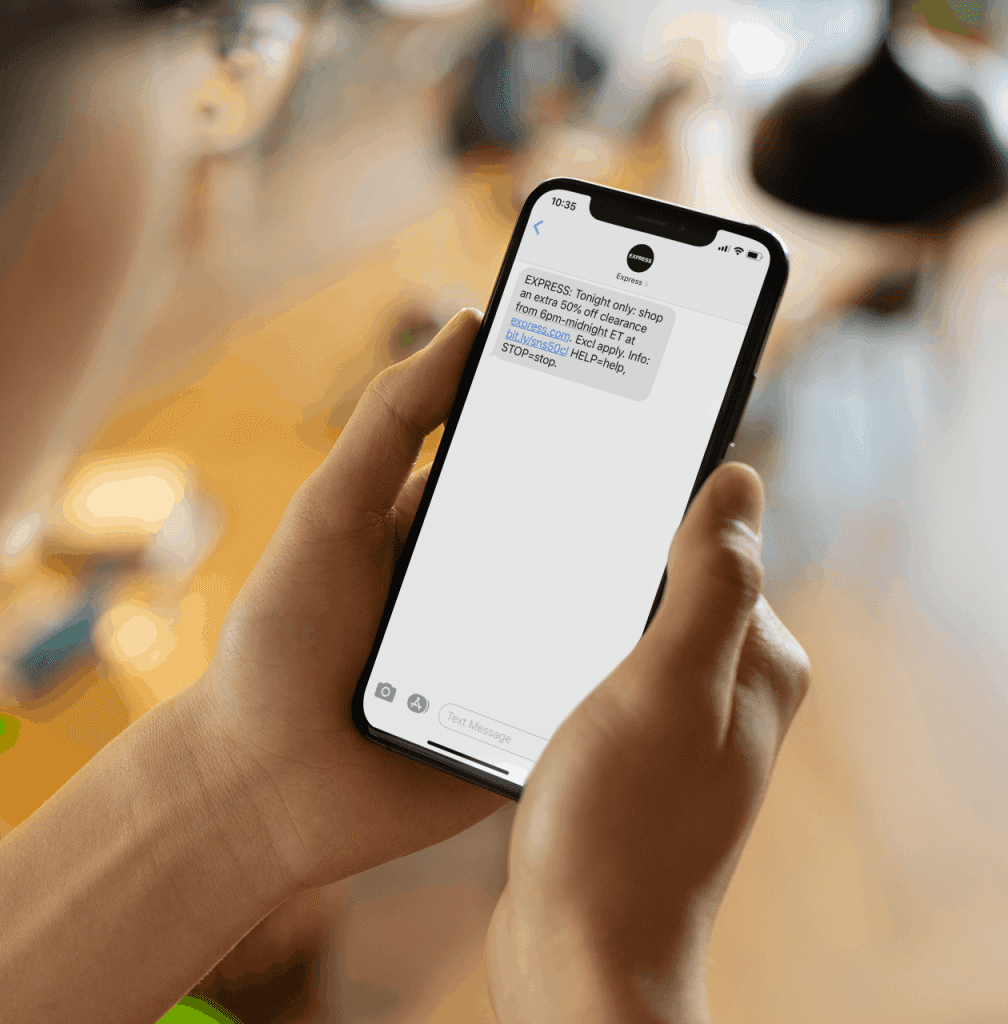

Checking FAB Balance Through SMS

Fab Bank makes easy and convenient ways for the convenience of its customers. So that no Fab Bank customer faces any problems, that’s why Fab Bank is called the biggest bank in UAE.

There are 3 ways to check balance via SMS, first is through WhatsApp, second is using WhatsApp, and third is through missed calls. It is 4th the best way to Check Your FAB Account Balance.

To check your remaining balance via SMS on Fab Bank, you must have an SMS package on any UAE SIM.

- Via SMS: Write “BAL” in the new message and send the message to 2121. You will receive your fab bank remaining balance message shortly.

- Use WhatsApp: To check your balance via WhatsApp, type the message “Balance” or “Available balance” from your registered number to Fab Bank WhatsApp +971 56 518 9997, and send it. Within a short time, you will receive a message about the remaining balance through Fab Bank’s bot system.

- Missed call service: To check your balance through missed calls, make a missed call on 8476762 from your registered mobile number. You will receive an automated call informing you of your remaining balance.

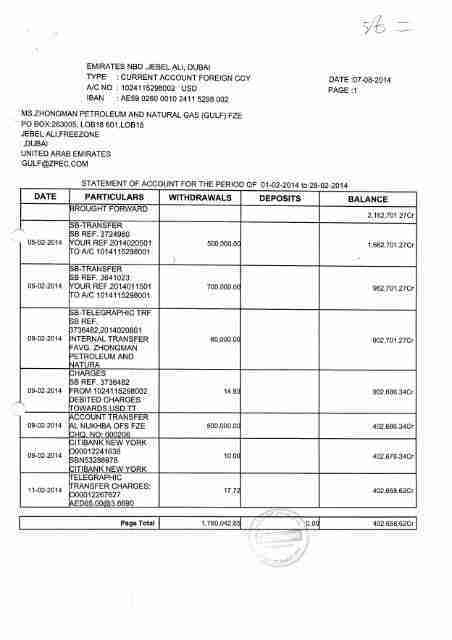

How to Check FAB Bank Statement

Your fab bank statement can be accessed in 3 ways. Which includes the FAB bank online website, the FAB bank mobile app, and ways to get statements by visiting the FAB bank branch.

Online website: Visit Fab’s official website using this link, and enter your FAB ID/Rewards number and PIN. After logging in, click on Accounts. You will see a few options, including the view statement option at the bottom. Click on View Statement and click on the date you want the statement. You will see the statement download it and get it on your mobile.

FAB Bank mobile app: You must have the FAB Bank mobile app for this process. Log in and click on Accounts. Now click View Statement, and click on the date you want the statement. Now your statement is ready for download.

- Visiting FAB bank branch: Visit any FAB Bank near you. Request your statement along with the date from the representative at any counter in the bank. The representative will provide you with a copy of your statement within a few minutes. It is the 6th best way to Check Your FAB Account Balance.

Checking FAB Balance Through Customer Call Support

The last step is to check your balance by calling the customer. Call 600544444 to check the FAB balance through customer call support. Fab Bank’s customer help center representative will ask you for some information for verification.

Provide your correct information and request to know your remaining balance. The representative will tell you your remaining balance or send you the remaining balance information via SMS to your registered number. It is 5th the best way to Check Your FAB Account Balance.

Benefits of Checking FAB Balance Online

There are many advantages to checking FAB balances online. Here are some of them.

Check your balance anytime 24/7.

- Avoid ATM fees

- Online transaction tracking

- Calling the helpline and waiting

- Avoid long queues at the bank to check your balance.

- Avoid fraudulent transactions and contact the bank immediately.

Online FAB app has many more benefits. You can pay your bills, transfer between accounts, recharge your mobile phone, manage your transactions, and receive account alerts from your Fab Bank account.

FAB Cashback Offers For Expats

If you have also come to Dubai, FAB Bank has a bonus on foreign salaried sections, including 5%+ in credit cards, in al-Futtaim, and 750 AED welcome bonuses. Fab Bank Cashback Offers provides 5% of supermarkets/fuel/utility stores on Islamic cards to customers with FAB salary accounts. Check FAB cashback offers for Expats in this table.

| Earnings | Cashback (UAE National) | Cashback (Expatriate) |

| AED 0 – 2,999 | Zero | Zero |

| AED 3,000 – 4,999 | AED 1,000 | AED 500 |

| AED 5,000 – 14,999 | AED 2,500 | AED 1,500 |

| AED 15,000+ | AED 5,000 | AED 2,500 |

Open your FAB Bank salary Account right now, and get this Fab Cashback offer for expats offers. If you want to open your account online, read this article on how to open your FAB Bank Salary Account.

How to Redeem Cashback

You can redeem your Fab Cashback through a Fab Mobile app and the FAB bank official website. Here are simple ways of redeeming your cashback. By following these methods you can get your cash bank balance into your account.

- Install the Fab Mobile app on your mobile.

- Login to your app or online mobile app.

- Go to the Fab Rewards option.

- Click on the “Pay with FAB Rewards” or the “Reimburse transaction” option.

- Select and confirm the desired transaction/bill.

- Now get your prize in a few moments.

What Is FAB Swift Code?

If you want to send a payment via wire transfer in or out of the UAE, you may need a FAB Bank SWIFT code. FAB Swift Code is the code of various branches of FAB Bank. Each Fab Bank branch has a different Swift Code. If you want to know your Fab Bank SWIFT code in UAE then visit your Fab Bank mobile app or official website.

Or view your Payback statement and you will see your account branch code. Also, click on this link to view Swift Finder, after which you will be redirected to the official website of Fab Bank. Then click on Swift Finder. This will help you find your correct SWIFT code.

The general format for a FAB SWIFT code is four letters representing the bank (NBAD), two letters representing the country (AE), two digits representing the location (branch code), and three optional digits for specific departments. (usually XXX). Still, if you don’t get the FAB Swift Code valid then you can find your Swift now by calling 600544444.

What is the blocked amount in FAB?

The blocked amount in Fab Bank is called the amount placed on temporary hold. For example, FAB savings accounts, such as the “Manage Your Money” account, may temporarily hold part of your deposit for a specified period.

This is to ensure sufficient funds for future automated transactions such as monthly fees. The blocked amount will be released after the relevant transaction is processed. Also, if you are sending a large amount of money internationally or domestically, some of your funds may be blocked by Fab Bank.

You cannot use the blocked funds in your remittances, your funds are unblocked after sending the payment. Fab Bank blocks some of your credit while renting a car or hotel in the UAE.

This reduces your existing credit but once the amount is settled your blocked amount is unblocked again. In some cases, your funds get blocked due to Fab Bank technical issues but it gets fixed again in no time.

Advantages Of Using The FAB Balance Check Service

There are many advantages to checking FAB balances online. Check your balance anytime 24/7 with its help. Avoid ATM Fees with FAB Balance Check Service. Keep track of online transactions.

Call the helpline and avoid the hassle of waiting. No need to stand in long queues at the bank to check your balance. Facilities to avoid fraudulent transactions Contact the bank immediately if any wrong transaction has taken place.

Online FAB app has many more advantages. Like paying your bills, transferring between accounts, recharging your mobile phone, managing your transactions, and getting account alerts from your Fab Bank account, etc.

Benefits of FAB Prepaid Card

FAB prepaid card has many advantages. As FAB Ratibi prepaid card can be availed without opening any bank account. Apart from this, you can do online or offline shopping with prepaid cards, travel anywhere in UAE, get services like Mastercard or Visa card, etc.

No minimum salary: Get your FAB Ratibi salary card account without any salary requirements. No matter how minimum or maximum your salary is, the Fab Bank provides a Ratibi salary card to its customers without any conditions.

Directly Deposited into a card: If you have a Ratibi Salary Card, you do not need to take cash and go to the bank and submit it. You can easily get your salary on your Ratibi Salary Card.

Withdraw money: You can withdraw money from a Fab Bank ATM as per your need. Which allows you to save more of your earned money.

Online Shopping: If you want to do online shopping, the Fab Ratibi Salary Card provides you with facilities like Visa and MasterCard. Attach your card to shopping websites like Amazon, eBay, or Alibaba, and take advantage of your intestinal shopping.

Offline Shopping: Pay the bill with your card at other shopping malls, stores, petrol pumps, or other stores in Dubai. Also, travel to transport such as Dubai Metro stations, buses, Taxis, or trains and pay your bill with your card.

Insurance or Loan: The Fab Bank also provides insurance or loan facilities for salary cards. This allows you to get your insurance or loan from the Fab Bank. Remember that insurance or loans are given for maximum use of salary cards and different cards of Fab Bank.

What is the minimum balance in FAB Bank?

In FAB the minimum balance charge is divided into different accounts. Personal Savings Account must have 3000 AED per month for which a monthly fee of 25 AED is applicable. Apart from this, accounts like FAB One Current, iSave, Kids, and Smart Junior do not have any minimum fee or charge requirement.

FAQs

Visit any FAB Bank ATM near you and insert your card into the ATM. Enter your 4-digit PIN at the ATM. Click on the Accounts option and get your remaining balance receipt from the ATM after clicking Balance Enquiry.

In FAB the minimum balance charge is divided into different accounts. Personal Savings Account must have 3000 AED per month for which a monthly fee of 25 AED is applicable. Apart from this, accounts like FAB One Current, iSave, Kids, and Smart Junior do not have any minimum fee or charge requirement.

FAB Bank does not require any minimum salary requirements for the FAB Bank Ratibi Card. It is a prepaid card used by the salaried class and can be availed without any monthly fee.

You can view your IBAN on your Fab Mobile Banking app or checkbook. Also, go to IBAN Generator and enter your bank account number, and branch code. Your IBAN will be generated at the same time.